Determining profit margin

What You Need to Know. There are four subfactors that are to be considered in determining contractor effort.

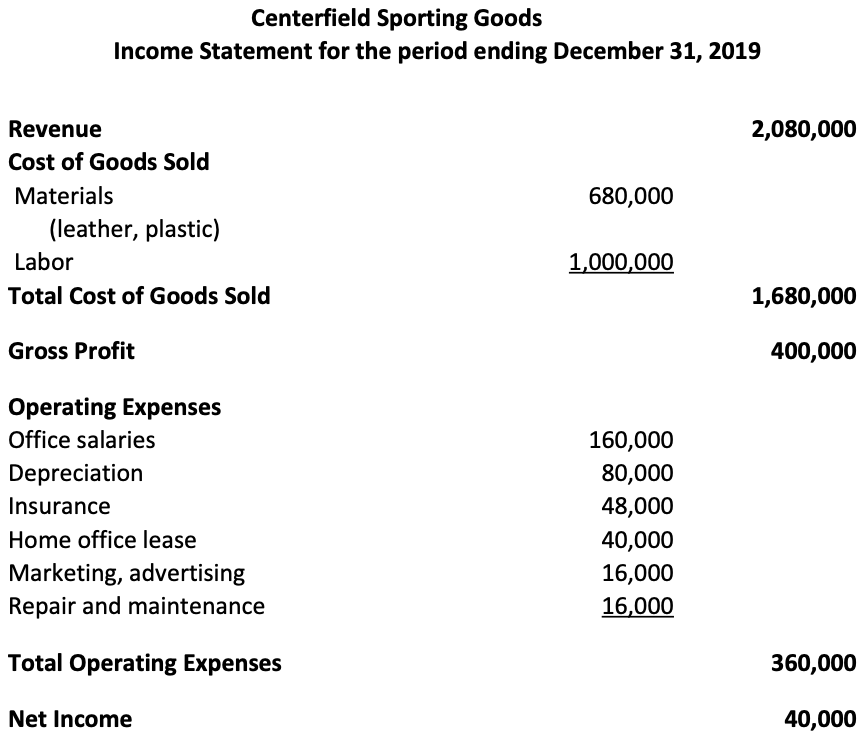

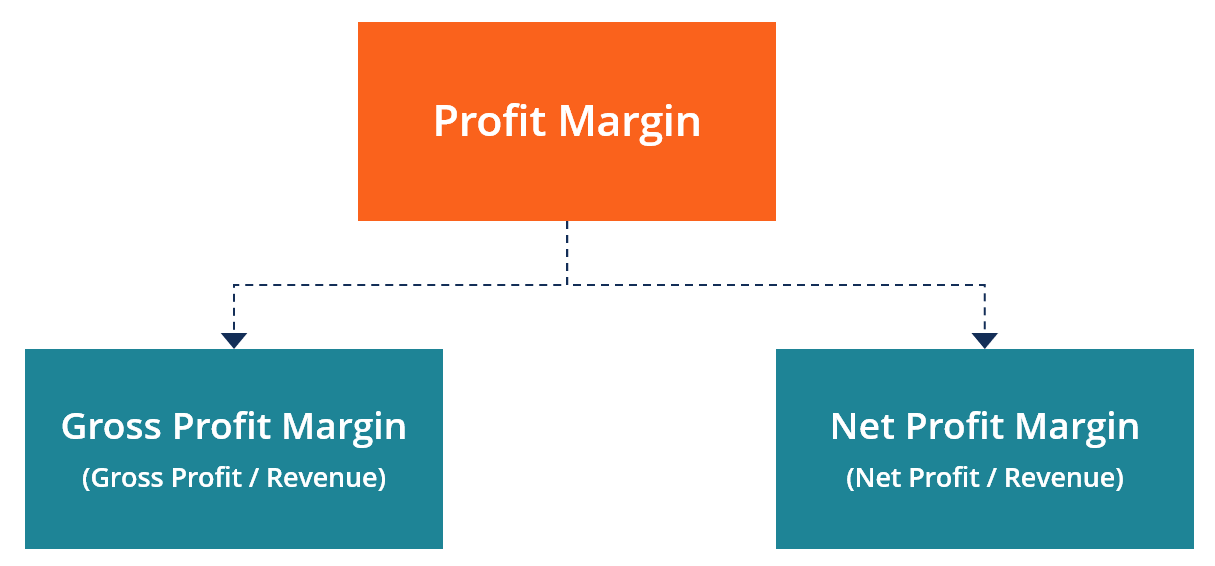

Gross Profit Margin Vs Net Profit Margin Formula

Which is the best frame of reference for determining if an investment is good.

. Determining costs requires keeping records of goods or materials purchased and any discounts on such purchase. Over the last century the stock market has returned an average of 10 on investments. Sales margin.

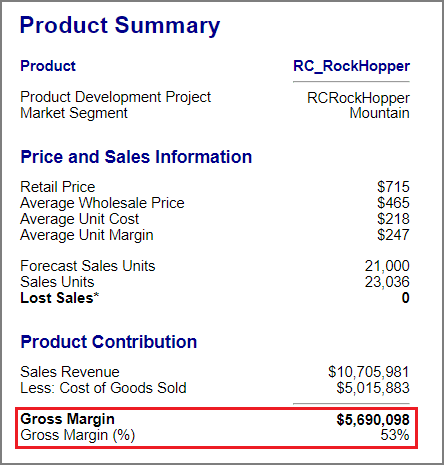

Profit margins can be trickyboth determining them and understanding whats right for your business. Gross margin puts gross profit into context by taking the companys sales volume into account. Gross profit margin indicates the profitability of a business and is a measure of a businesss financial health.

Compare for example the profit implications of a 1 increase in volume and a 1 increase in price. Now gross profit margin is a ratio that shows the relationship between a companys gross profit and its net revenue. The range for average restaurant profit margins typically lies between 0-15 but the average restaurant profit margin usually falls between 3-5.

Any Introduction to Statistics textbook will explain how outliers data points on the extreme ends of a spectrum affect averages. His profit in 2008 is 50 and his profit in 2009 is 110 or 160 in total. The process begins with determining the cost of your goods.

Selling marketing administrative expenses taxes and other costs have not been deducted before determining gross profit. As part of the deal the customer is granted a 10 discount. The gross profit margin is helpful in determining how well a company is generating revenue from the costs involved in producing their goods and services.

If you want to know how to determine pricing for a service add together your total costs and multiply it by your desired profit margin. The firm can sell more or choose to have a bigger profit margin. Youll want to.

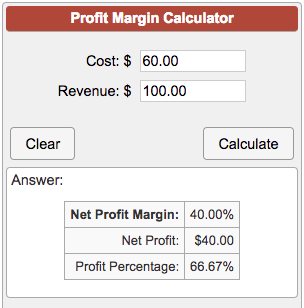

Here is an example of the profit margin formula at work if total revenue is 150000 and total expenses are 138000. To calculate the sales margin on a percentage basis divide the sales margin derived in the preceding calculation by the net sales figure. What does gross profit margin mean.

They also have their overhead leaving only part of the margin as their profit. A good profit margin means a business is very profitable. FAR 15404-4 establishes six factors for the analysis of profit.

The cookies stores a unique ID for the purpose of the determining what adverts. When all the firm. If he deducted all the costs in 2008 he would have a loss of 20 in 2008 and a profit of 180 in 2009.

First decide what percentage you want the profit margin to be. If the firm imports raw materials a depreciation will increase costs of production. It is used to analyze how efficiently a company is using its 1 raw materials 2 labor and 3 manufacturing-related fixed assets to.

But a 10 profit margin is typically average. In order to earn the margin distributors and retailers have to make costs for example for shipping storage financing and of course selling the goods. Contribution Margin Fixed Cost Net Income.

MOUNTAIN VIEW Calif. For example in the restaurant industry margins are typically less than 10 Wentworth said. The Federal Acquisition Regulation FAR addresses the subject of profit in Part 15.

Thus Contribution Margin Sales Revenue Variable Cost. This margin is useful for determining the results of a business before financing costs and income taxes. And the willpower to keep accurate accounting records are essential factors in determining whether o.

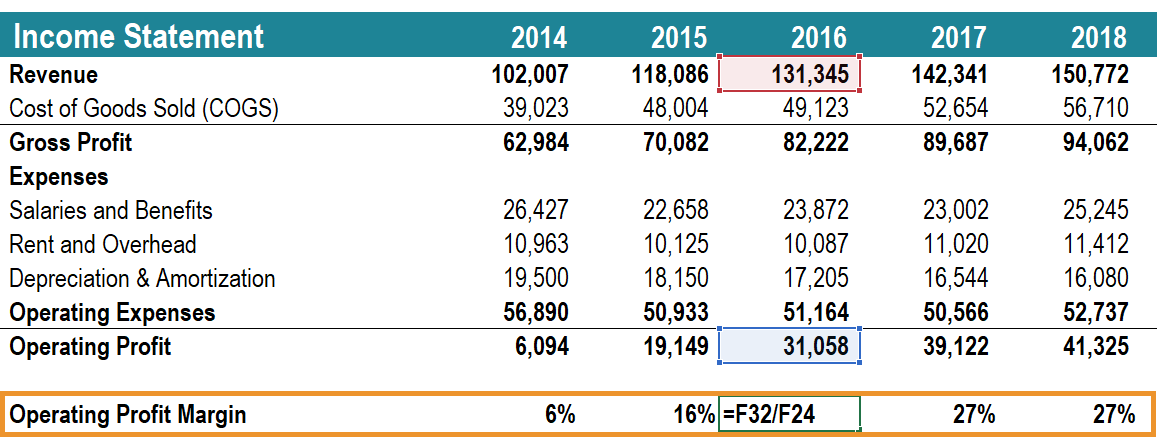

There are two types of profit margins you need to know. For example if sales are 100000 the cost of goods sold is 60000 and operating expenses are 25000 then the operating margin is 15000 or 15. Contribution margin is used to plan the overall cost and selling price for your products.

Thus it focuses on the real results of a business. It helps you in separating your fixed cost from variable cost. Determining gross margin is an easy and straightforward way to understand the core elements of a.

The gross profit margin is the percentage. SEOUL South Korea August 10 2022--Coupang Announces Q2 Record Gross Profit of 12 billion and Gross Profit Margin Improvement of 250 bps over Q1. Gross profit and gross margin also called gross profit margin are two key financial metrics that show the profitability of a business when comparing its revenue with its direct costs of production.

The contribution margin is your product or services price after subtracting any associated costs to manufacture or produce the item. Example of a Sales Margin Calculation. The gross profit margin is whats left over after you deduct the cost of drinks and food sold then multiply the sum by 100 to get a percentage ratio.

The range for restaurant profit margins typically spans anywhere from 0 15 percent but the average restaurant profit margin usually falls between 3 5 percent. Measures the complexity of the work and the resources required. An evaluation of factors that determine the profit of firms - including both demand side factors and costs.

Net profit margin is the ratio of net profits to revenues for a company or business segment. Net Profit Total Revenue x 100 Net Profit Margin. Gross and net profit margin.

For example a company sells a consulting arrangement for 100000. Typically expressed as a percentage net profit margins show how much of each dollar collected by a. Coming up with a fair margin is key to turning a profit.

Profit margins generally vary by industry. For a company with average economics improving unit volume by 1 yields a 33 increase in. However not all margin is profit.

Knowing your industry is key to determining if you are hitting the right profit margin. Income tax in the US. Further it also helps in determining profit generated through selling your products.

The average gross profit margin for bars and nightclubs is 70 to 80. Determine the contribution margin. The remainder is the profit your organization earns on each unit sold which is a necessary figure to know when performing a CVP analysis to find target profit.

What Is Gross Margin And How To Calculate It Article

Profit Margin Formula And Ratio Calculator Excel Template

Profit Margin Calculator

Profit Margin Guide Examples How To Calculate Profit Margins

Net Profit Margin Formula And Ratio Calculator Excel Template

What Is The Gross Profit Margin Bdc Ca

How Does Gross Margin And Net Margin Differ

What Is Gross Margin Definition Formula And Calculation Ig Bank

How Do Gross Profit Margin And Operating Profit Margin Differ

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

How Do I Calculate Gross Margin Smartsims Support Center

Gross Profit Margin Formula Meaning Example And Interpretation

Operating Profit Margin Learn To Calculate Operating Profit Margin

Gross Profit Margin Formula Definition Investinganswers

Gross Profit Margin Prepnuggets

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ